New Details from UMG’s Annual Report Lowkey Hint at Mavin’s Nine-Figure Acquisition Estimate

Driving this PREMIUM is Mavin’s unique position as an export-ready powerhouse, buoyed by streaming growth, lucrative brand partnerships, and a roster of artists with global appeal

Following news of Universal Music Group [UMG]’s majority acquisition of Mavin last year, one of the most-asked questions, particularly among music business professionals and external investors eyeing the African music scene, has been around the valuation at which UMG acquired Mavin. This curiosity is understandable, as not only is this deal a first of its kind in the African music business, but it also stands to set a precedent for future acquisitions, partnerships, and business transitions involving global majors and African music companies.

When Billboard first broke the story that Mavin was seeking investment or a potential sale, it hinted at a valuation range of $150 million to $200 million. Since then, all signals and indicators surrounding the deal - especially after UMG’s involvement - have largely circled back to that estimate. And honestly, that’s not surprising as the Billboard article was likely commissioned or shaped by parties involved in the deal - possibly Mavin’s financial advisor, Shot Tower Capital - to signal interest to the market and drum up attention from prospective investors. It’s even plausible that the story was designed to attract more offers, giving the sellers a better sense of the market appetite before locking in a final buyer.

PS: I’m not speculating this for drama’s sake; it’s mostly standard practice in finance. And as a Communications professional, I can read the subtext of such media placements and understand the intentions behind them.

Fast forward to UMG’s 2023 annual report, which typically offers a detailed overview of the company’s business activities. Nestled within that report was a clue about its investment in Mavin. By piecing that information together, especially alongside other disclosed investments like Chord Music Partners and NTWRK, I was able to guesstimate a likely valuation for the Mavin deal. My calculation point right back to that $150 million to $200 million range first mentioned by Billboard.

I've seen conversation online - and been part of many offline - questioning whether the Billboard figures were inflated for PR. But with each new bit of publicly available data on UMG’s broader investment activity, the value of Mavin's majority acquisition appears to fall squarely within that range.

Highlights from Last Year’s Analysis

In typical fashion, Universal Music Group (UMG) has released its 2024 annual report, and within the 284-page document lies yet another key info that supports my earlier analysis of its majority acquisition of Mavin Global last year.

For the uninitiated, lets briefly revisit the foundation of my earlier analysis before layering in the latest development.

So, based on publicly available data as of February 2024:

- UMG had confirmed investments in Chord Music Partners ("Chord"), NTWRK (the parent company that acquired Complex), and Mavin Global ("Mavin"). The total cash consideration across these three investments was disclosed to be approximately €450 million.

- Using the average 2023 exchange rate, €450 million converts to about $486 million

- Now, only one part of this puzzle is clear: the details of UMG’s minority investment in Chord Music Partners was made public. UMG acquired a 25.8% stake in Chord for $240 million, in a deal that valued the company at roughly $1.85 billion.

- This leaves us with a remaining $246 million [from the original $486 million] earmarked for both the Complex/NTWRK investment (a minority stake) and the Mavin Global majority acquisition.

- Turning to Complex now - We know from reports that Buzzfeed sold Complex to NTWRK for $108.6 million. UMG, in turn, made a minority investment in NTWRK (obviously less than 50%). Even without knowing the exact percentage UMG holds in NTWRK (as the info wasn’t public at the time), we could safely assume that the bulk of the remaining $246 million went to acquiring a majority stake in Mavin.

- That was what informed my alignment with Billboard’s previously reported range of $150 million to $200 million for the Mavin acquisition.

UMG Latest Annual Report

However, at the time of my initial analysis, my estimate was still largely speculative because UMG had not disclosed the exact size of its minority stake in Complex/NTWRK. I only knew that it was less than 50%, which is typical for a minority investment. But now, UMG has revealed that it acquired a 28.6% stake in NTWRK, the live video shopping platform that had recently acquired Complex from BuzzFeed - with aim to create a destination for “superfan” culture.

This new information (28.6% figure) allows for devising a more refined hypothesis based on what I now know.

So, let's work with the numbers:

- UMG’s total known investment pool for Mavin and NTWRK = $246 million

- UMG’s stake in NTWRK = 28.6%

- NTWRK’s acquisition of Complex from BuzzFeed = $108.6 million

So NTWRK is likely valued somewhere at or likely above $108.6 million. For a conservative-to-moderate estimate, let’s assume NTWRK’s overall valuation falls in the range of $108.6M to $150M.

Let’s estimate UMG’s investment in NTWRK:

If UMG now owns 28.6% of NTWRK, we can say:

- At a $108.6M valuation, UMG’s 28.6% stake = $31.04M

- At a $150M valuation, UMG’s 28.6% stake = $42.9M

Meaning UMG likely spent somewhere between $31 million and $43 million on its NTWRK/Complex investment.

Now, let’s reverse engineer the Mavin deal:

Subtracting that NTWRK/Complex investment from UMG’s $246M total investment budget, we should get:

- $246M – $31M = $215M (if NTWRK cost less)

- $246M – $43M = $203M (if NTWRK cost more)

That leaves us with a likely range of $203 million to $215 million potentially allocated toward acquiring a majority stake in Mavin Global.

Where UMG’s Head is At

Over the past few months, we’ve been closely watching UMG’s strategy across emerging markets as it has called Nigeria a high-potential growth hub, alongside key territories like China, India, Vietnam, Indonesia, and Thailand.

In several earnings reports and public statements, UMG has hinted at a “triple-pronged” approach to these regions, viz:

- Building local A&R teams to discover and nurture talent at the source,

- Providing support services to independent entrepreneurs and labels via its indie-focused arm, Virgin Music Group, and

- Pursuing mergers and acquisitions (M&A) to accelerate market entry and scale.

Now, in light of its investment in Mavin Global, we’re seeing that M&A strategy in action. It fits within the larger framework of how UMG is planting deep roots in these high-potential regions. The company is also actively acquiring or partnering with smaller, agile companies, especially those run by entrepreneurs who’ve built their businesses independently. This is where Virgin Music Group plays important role. Beyond distributing or supporting indies, Virgin is becoming a conduit into UMG’s global ecosystem, offering a soft-landing platform that may [over time] lead to full acquisition. A clear example of this is the partnership between Virgin and Nigeria’s DVPPER Music, a fast-growing distribution and label services company in Nigeria.

If you missed our report from the past year, DVPPER was the second leading music company by Spotify Nigeria market share.

More recently, Virgin seems to be extending its footprint beyond Nigeria, with its recent partnership with Ghana’s RainLabs, an indie hub whose roster includes artists like Joey B, Cina Soul, Baaba J, MAUIMØON, Kofee Bean, Ess Thee Legend, and AD DJ.

At UMG’s most recent earnings call, CEO Lucian Grainge referenced these moves directly, describing the partnerships with RainLabs in Ghana and Hungama Digital Media in India as part of UMG’s global expansion strategy.

Back to Mavin

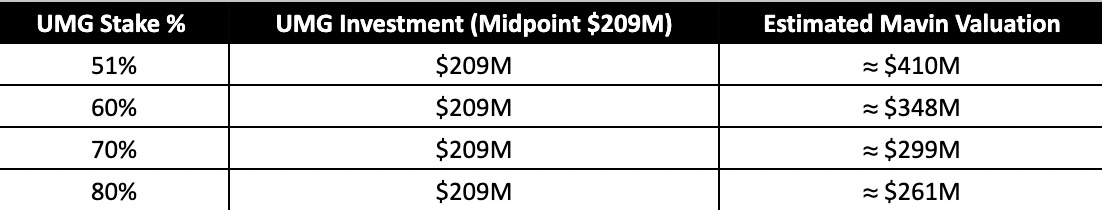

I’ve been thinking about what UMG’s majority stake in Mavin implies for the label’s overall valuation. Now, in standard deal terms, a “majority stake” is typically understood to mean anything above 50%, and in deals like this, it’s commonly between 51% and 80%. The goal here is to understand what percentage of Mavin this investment may have bought and therefore, what the implied total valuation of Mavin would be.

Let’s work with the investment range we already estimated from UMG’s reports: $203 million to $215 million

So here’s how I’m thinking about it - let’s consider different stake sizes; starting from 51% up to 80% and calculate what each of those scenarios suggests about Mavin’s total valuation.

So, UMG’s acquisition of a majority stake in Mavin Global places the label’s valuation somewhere between $260 million and $400 million. Driving this premium is Mavin’s unique position as an export-ready powerhouse, buoyed by streaming growth, lucrative brand partnerships, and a roster of artists with global appeal, most notably Rema and Ayra Starr whose crossover success has reshaped what’s possible for Afrobeats on the world stage and they’ve done it at impressively young ages.

This is why, as I mentioned on my socials last week, the constant temptation to taunt or downplay the value of Nigerian streams is reductive and doesn’t always tell the full story. It’s true that streams from emerging markets like Nigeria do not carry the same monetary weight as those from North America or Europe. But impact-wise, they offer something to work with [Buzz - if you may]. The kind that primes virality, fuels discovery, and triggers a domino effect across diaspora communities and eventually global discovery.

Before “Laho” (which, by the way, is now shaping up for global take-off), there was “Elon Musk” and an obscure Shallipopi - now backed by Sony via Since '93. All that momentum began with Nigerians, while he was with DVPPER, well before global industry ears tuned in.

Before “Calm Down” became one of Afrobeats most-successful songs ever, there was “Dumebi” and platforms like Homecoming that helped launch Rema. And before the Ayra Starr we know today, there was “Bloody Samaritan”, and a string of milestones that all started right here, in Nigeria.

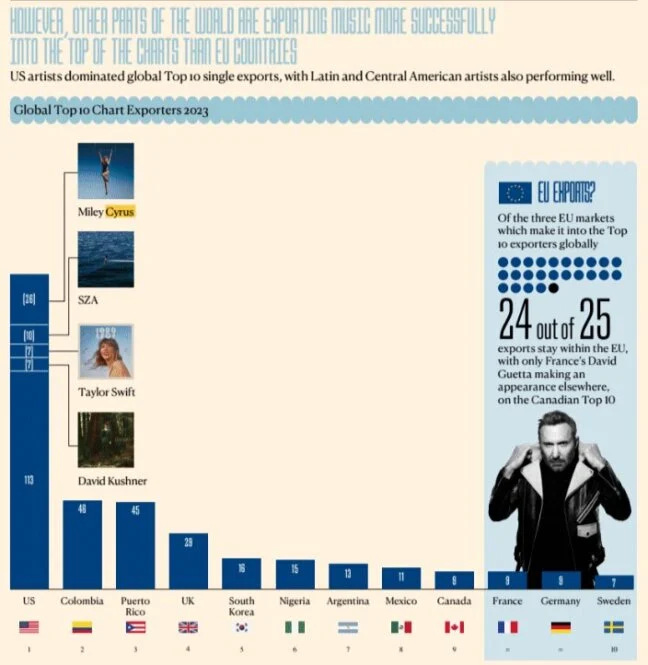

This is why it’s misleading when people imply that Nigeria has “nothing to offer” just because its streams don’t convert to major revenue. It’s a fundamental misunderstanding of what the Nigerian market really is and has always been. We are an export engine and from an IFPI report last year, Nigeria was mentioned as the 6th Largest Music-Exporting Country in the World, trailing behind the US, Colombia, Puerto Rico, the UK, and South Korea.

Don’t get me wrong, internally generated revenue is great and as I’ve said in a past piece, if Nigeria had a stronger economy and better streaming infrastructure, Mavin’s valuation could’ve gone even higher because for all its global clout, Nigeria remains Mavin’s primary market. But as it stands, its mostly Nigeria’s cultural capital that companies like UMG are investing in and not exactly because they expect Nigeria to be a top-revenue market immediately.

And this approach isn’t exclusive to UMG. Back in February, I referenced Emmanuel Zunz, CEO of ONErpm, who said the company is doubling down on its investment in Nigeria. In a prior conversation with Music Business Worldwide, he echoed this same framing:

“Emerging markets are volatile, which makes them interesting but also slightly riskier. Nigeria is mostly an export market. Most of the consumption of Nigerian music occurs in Europe, the UK, and the US.”

Nigeria’s position as an export market means a lot for valuation, artist strategy, and revenue diversification.

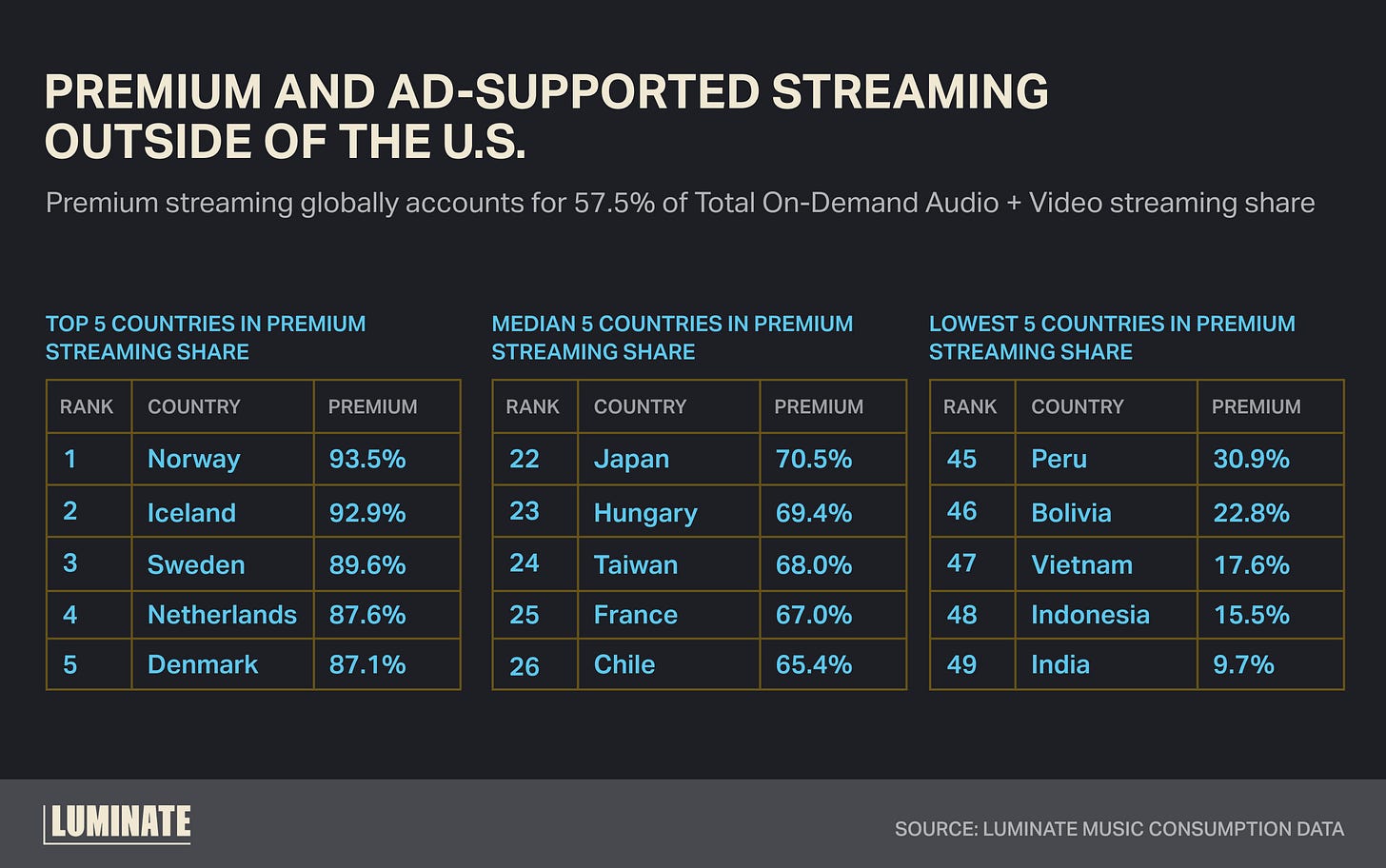

It often starts as a launchpad where artists build momentum, cultural capital, and street-level buzz that eventually travels across borders. From there, the play is to tap into international markets where streaming revenues are more stable and lucrative, due to stronger economies and higher subscriber spend.

Markets like Latin America and select European countries, where Average Revenue Per User (ARPU) for premium streaming is higher, have emerged as particularly attractive destinations for Nigerian artists. For rightsholders facing revenue volatility at home due to naira devaluation and a fragile economy, these regions offer a new kind of lifeline.

In the UK, for instance, terms like “soft life” which originated in Nigeria, are becoming increasingly popular. The rise of artists like Shallipopi or the momentum behind records like “Laho” are direct reflections of Nigeria’s cultural output. Even UK artists like Central Cee and Stefflon Don draw from or interact with Nigerian pop culture in one form or another.

That’s how you de-risk your catalog, build sustainable streaming income, and ultimately increase valuation.