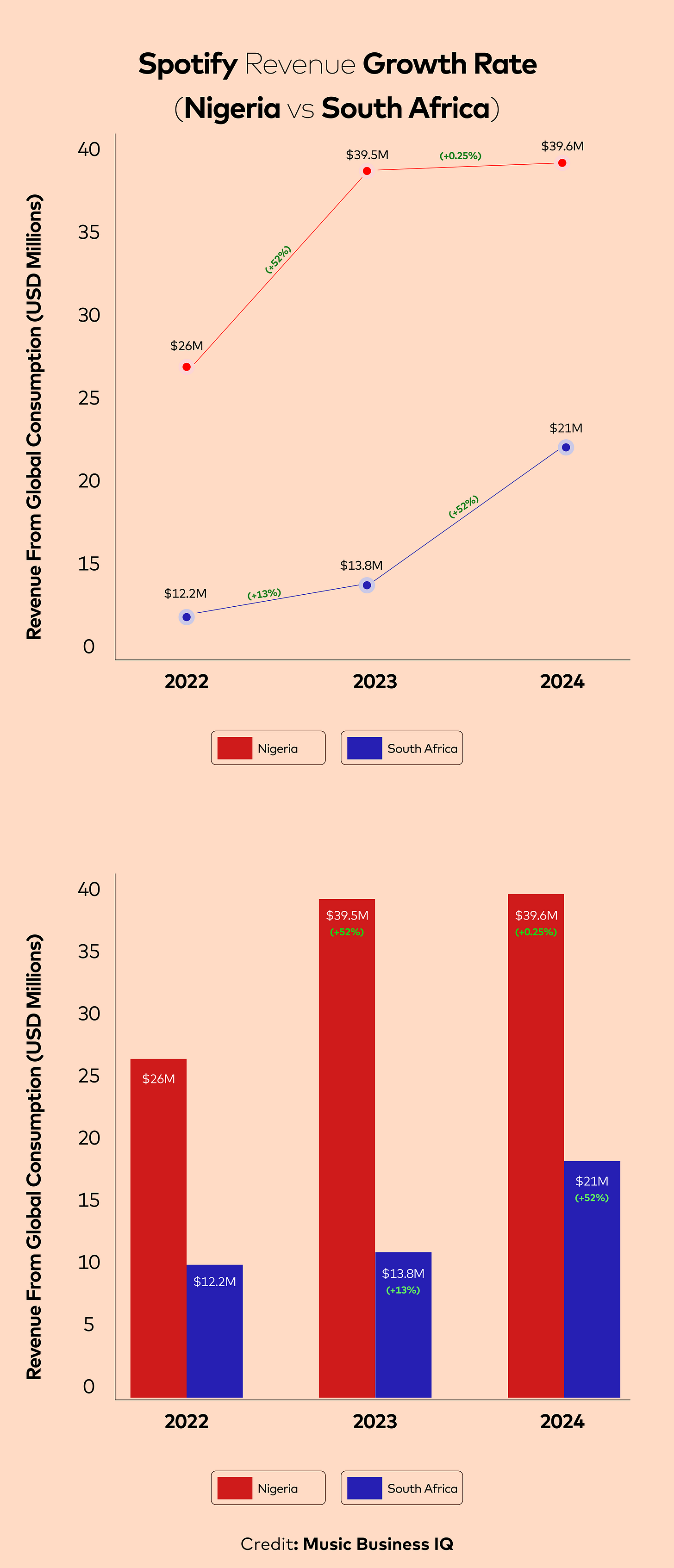

South Africa Sees Record YoY Growth in Spotify Revenue, Up 52% in 2024 🚀

South Africa's growth rate of 52.17% in USD terms far outpaces Nigeria’s 0.25% YoY growth

South Africa stands tall as one of the leading music markets in Sub-Saharan Africa -arguably the most important even. Beyond being a regional giant, South Africa is a global launchpad for genre-defining sounds like Amapiano and Gqom, which at this time, no longer need introductions.

Last week, Spotify released its Loud & Clear report for the South African market, giving a deep dive into how the country’s music industry performed in terms of streaming revenues, discovery and global consumption on the platform throughout 2024. If you followed our breakdown of Nigeria’s Loud & Clear figures, you’ll see we explored the financial realities and streaming growth in detail.

Check it out here, if you missed it.

Of course, I planned to take a comparative look again—just like we did last year—by looking at Spotify revenues from Nigeria and South Africa, the two largest markets in Sub-Saharan Africa (SSA). But then came an actual prompt from one of our South African subscribers and that was all the nudge I needed. I’d shared on my socials earlier that South Africa is one of our top regions, so it just makes sense. It was our second-largest market for a minute until I found out recently its been overtaken by the US, UK and Ghana.

You can catch that post here

So, without further ado, let’s look at takeaways from Spotify’s 2024 Loud & Clear report for South Africa.

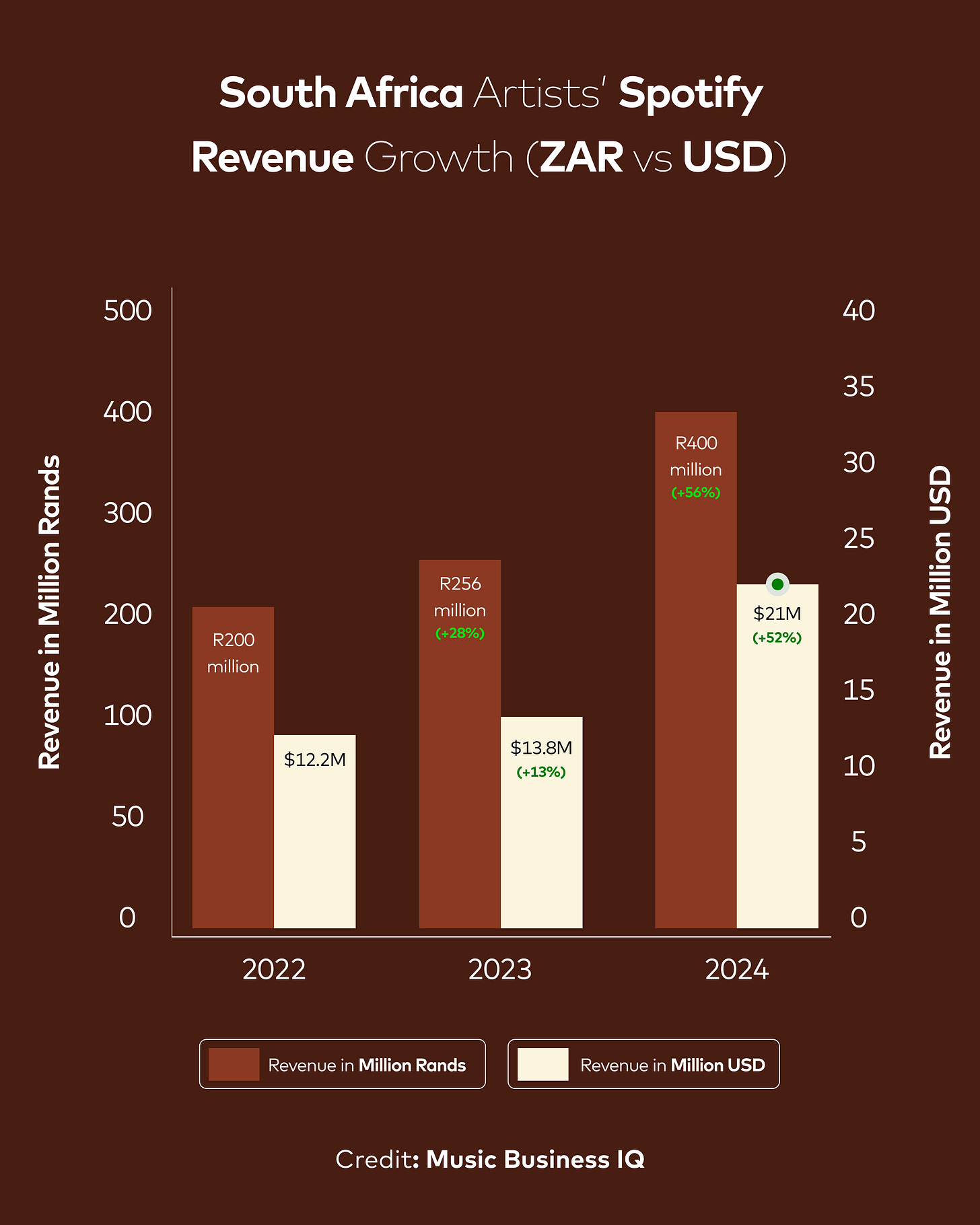

In 2024, South African artists earned nearly R400 million in royalties from Spotify, marking a ~56% increase from the nearly R256 million reported in 2023.

Here’s a quick snapshot of the growth:

- 2022: ~R200 million

- 2023: ~R256 million (+28% in ZAR)

- 2024: ~R400 million (+56% in ZAR)

To get a clear sense of the market’s growth - especially as Spotify also pays royalties in USD - we have converted these figures using the average annual exchange rates for each year (as currency rate fluctuates, so using annual average is more accurate for year-end data and financial analysis):

- 2022: ~R200 million ÷ 16.37 (ZAR/USD annual average in 2022) = ~$12.2 million

- 2023: ~R256 million ÷ 18.46 (ZAR/USD annual average in 2023) = ~$13.8 million (+13.11% in USD)

- 2024: ~R400 million ÷ 18.99 (ZAR/USD annual average in 2024) = ~$21 million (+52.17% in USD)

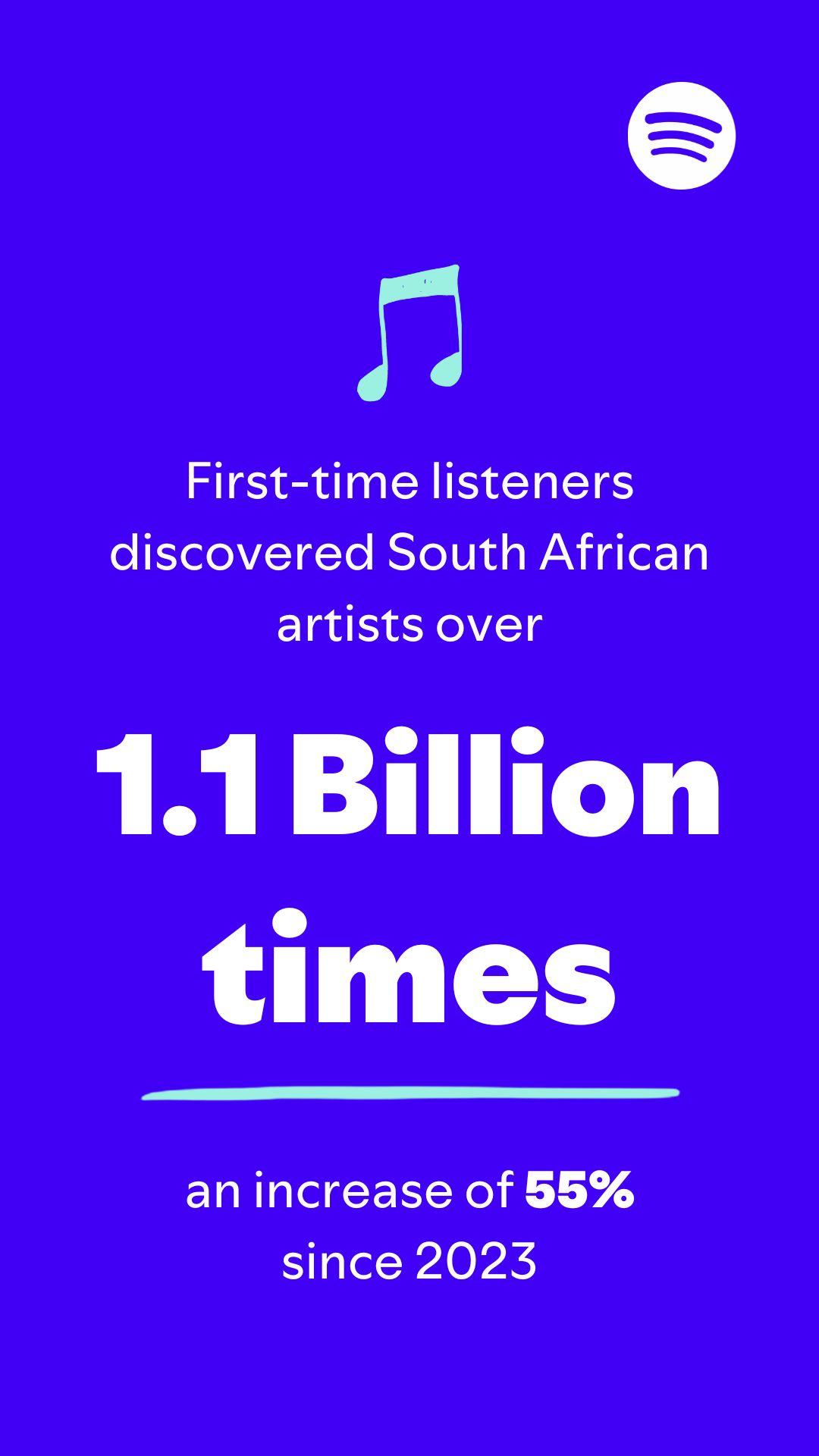

This growth isn’t just in raw numbers, it extends to reach and visibility opportunities as Spotify also reported that South African music was discovered by first-time listeners over 1.1 billion times, a 55% increase from 2023.

“We’re not just supporting South African artists – we’re revolutionizing how they build sustainable careers,” said Jocelyne Muhutu-Remy, Managing Director for Sub-Saharan Africa at Spotify. “Our ecosystem empowers artists to earn equitably from their talent while driving a powerful wave of cultural innovation that resonates globally.”

Spotify didn’t mention the proportion of revenue from international versus domestic listeners, but perhaps that’s not even necessary. South Africa knows how to hold its own, on just about any front you can think of.

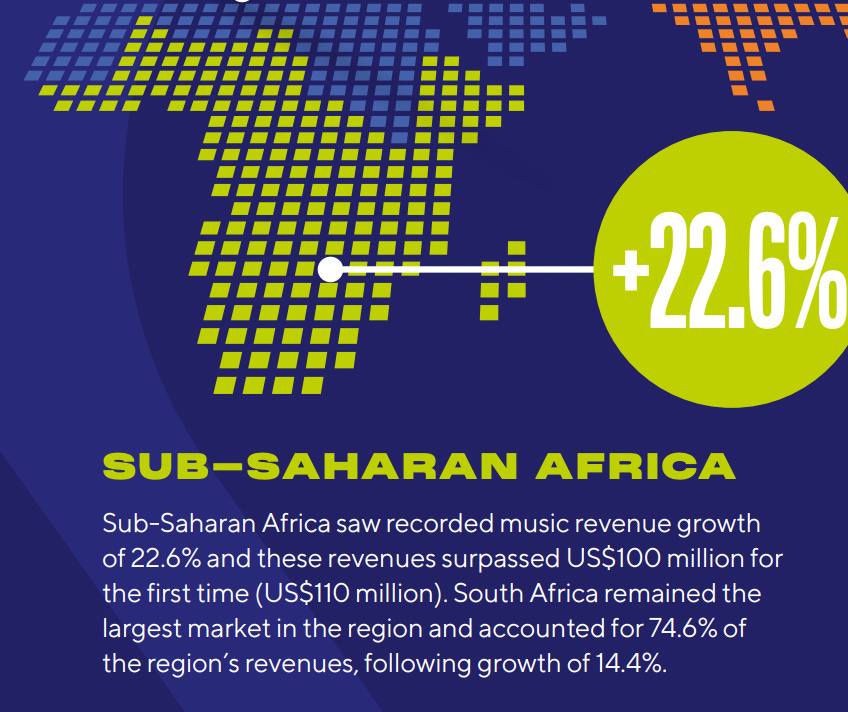

IFPI’s latest report gives credence to this point:

Sub-Saharan Africa recorded a 22.6% increase in music revenues in 2023, surpassing $110 million for the first time. SOUTH AFRICA alone accounted for 75% of that total, following 14.4% YoY growth.

This reduced by 2% from the 77% we reported last year. IFPI reports are tailored to each region’s domestic consumption growth BTW. So, that is fairly commendable!!

While Nigeria ($39.6m) may have edged out South Africa ($21m) in total Spotify royalties last year, the South African growth rate of 52.17% in USD terms far outpaces Nigeria’s 0.25% YoY growth. Should both countries maintain their current trajectory, South Africa could soon lead SSA in streaming revenue by global consumption.

South Africa, by all indications, has been on a roll beyond digital consumption. In December 2024, Chris Brown pulled about 90,000 fans over two nights each to the FNB Stadium. Last month, Tems had her first headline show at The Dome (10k+ capacity) - right next to the FNB Stadium - drawing fans with ticket prices ranging from R1,310 ($68.50) for VIP access and R800 ($41.80) for General Admission. Meanwhile, Travis Scott has recently announced a Johannesburg stop for his CIRCUS MAXIMUS WORLD TOUR in October 2025, and Doja Cat is set to headline Hey Neighbour Festival in Pretoria this August. These landmark events signal a [music] ecosystem that’s not only bubbly (👀) but also commercially viable.

Perhaps, one of most exciting takeaways from the report is how more South African artists are now earning meaningful income. Spotify says the number of artists generating over ZAR 100,000 and ZAR 500,000 in royalties has more than doubled since 2023.

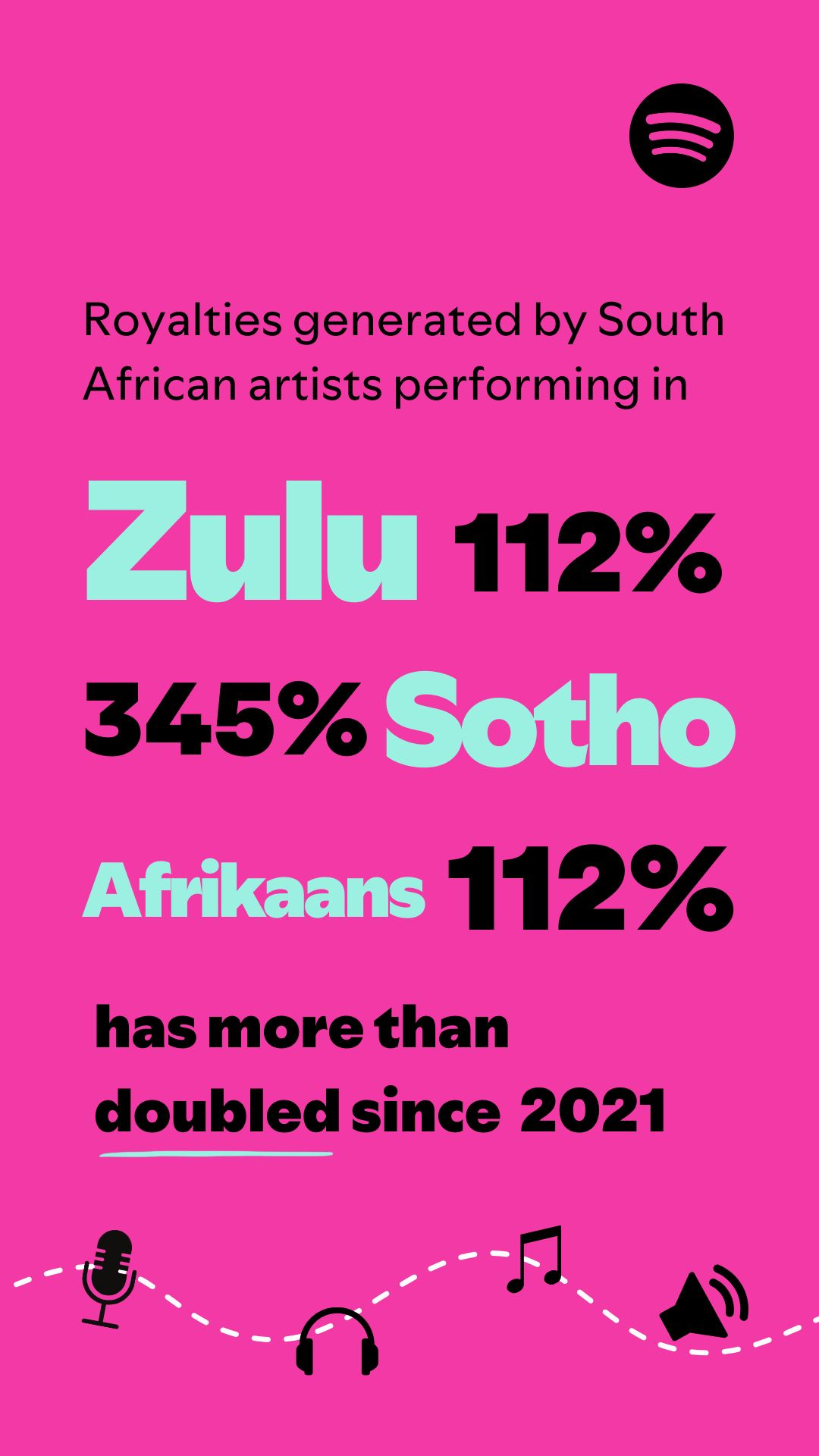

The love for local languages is also translating into revenue:

- Zulu: +112% growth in royalties

- Sotho: +345%

- Afrikaans: +114%

This surge underscores the global appetite for authentic, local-language content from South Africa. Spotify also reported that over 3,000 South African artists were added to editorial playlists, with their music featured in 220 million playlists - 17 million of which were created by local fans themselves.

Way to go, SA! 👏

Is this the part where we go “Haibo!”??? 😅💃🏻