Spotify Admits Its Investment in Nigeria Is Paying Off

Spotify's strategy of “seed, grow, dominate” is clearly playing out in Nigeria and here's proof!

In February, at the soiree marking ONErpm’s fifth anniversary in Nigeria, I ran into Dolapo Amusat, founder of WeTalkSound. While we exchanged pleasantries, as we usually do, we tried to recall the last time we’d met or spoken. When I remembered it had been at the Spotify Wrapped party in December, just two months earlier, he nodded in agreement and said, “Of course, it has to be. They’re the only ones always bringing everyone together.” That exchange planted the seed for this piece, as I’ve been ruminating on the best angle to tell the story of Spotify; a seemingly late entrant into the Nigerian market that is slowly outperforming its contemporaries, most notably Apple Music who arrived much earlier, since 2015. More than anything, that exchange underlined a recurring theme in my subconscious of how Spotify’s market engagement in Nigeria is unlike anything we’ve seen from its contemporaries.

Fittingly, that period also marked Spotify’s fourth year in Nigeria, so it just made sense - if I do say so myself!

Despite launching in South Africa in 2018, Spotify didn’t arrive in Nigeria until February 2021. By then, Apple Music and Deezer had already long established their presence. For context, Deezer was the first DSP I used as far back as 2018, and I loved it then. Despite newer platforms emerging, I clung to Deezer, for familiarity's sake, I guess? However, it was clear even then that Deezer wasn’t really invested in the African market, so somehow, they lost me. I’m not sure I remember how or why; maybe because it lacked any meaningful local engagement. I can’t place it, but I know for sure its roadmap was tuned to France and its cultural peripheries.

Apple Music, on the other hand, had launched since 2015, but somehow, I think it wasn’t clear in their comms that Android users could access it. It was an app we all thought was just for iPhones; so I think that’s why I’d opted for Deezer. But by the time more people started to know Apple Music also works on Android and not just Apple devices, more people moved there. I’m not sure this was a deliberate campaign from Apple Music itself as much as it was word-of-mouth from friends and colleagues, but somehow, that’s how Apple Music gradually embedded itself into the Nigerian digital lifestyle. By the time Spotify finally launched, many (including myself) felt the window had closed. Apple Music had the head start, local partnerships, and the early adopter advantage. How can Spotify beat that, you would imagine?!

Like, why bother? 😅

Yet, quietly and determinedly, Spotify entered the scene; and within four years, flipped the script. Stay with me!

Unlike its competitors, Spotify didn’t just show up, it showed out with intent. From curated local playlists to culturally resonant campaigns, to bold influencer collaborations, Spotify immersed itself so deeply in the Nigerian sonic, social, and cultural scene. The depth of its investment was so visible, even the blind could sense it.

From Jocelyne Muhutu-Remy, who leads Spotify’s African operations; to Phiona Okumu who jumped ship from Apple Music to head the Music department at Spotify Africa; to Miche Atagana, a Google alum now driving its PR and communications efforts on the continent with assist from Irvine Partners, a creative communications agency, Spotify built a team with a laser-sharp focus on cultural alignment and community building.

I mean, think about Spotify’s love letter to Afrobeats’ global rise with the Journey of a Billion Streams campaign in 2023, or the handful of collaborations and brand integrations with names like Maybelline for GRWM initiatives (a staple in pop culture on platforms like TikTok and Instagram) which exemplify how makeup and music intersect.

Lifestyle influencers Saskay and Nimiie at the Spotify & Maybelline GRWM party in Lagos, Nigeria

These efforts reflect Spotify’s lifestyle integration and how it embeds itself in the seemingly mundane routines of everyday people. Think about the art activations, the games nights, and other culture-led experiences etc.

Spotify’s Music meets Gaming initiative

Think of all these not as random events, but as part of a sophisticated user acquisition strategy centered on discovery and resonance. Taking stock of Spotify’s market activity, I deduced it was never just about streaming. It was about storytelling, community, and shared identity. And that’s exactly why Spotify’s investment in Nigeria is paying off. Don’t just take my word for it; David Kaefer, VP of Music Business at Spotify, confirms Nigeria is one of the markets where Spotify’s investment is already yielding results.

“Today, we’re seeing tremendous growth across markets like India, Brazil, Mexico, and Nigeria. These are places where our investments are paying off,” he said.

Hearing “paying off”, you may argue, “...but Nigerians don’t contribute much to Spotify’s topline revenue-wise,” and honestly, that’s fair argument, as we’d cited issues of low Premium uptake, FX instability, and limited spending power as issues plaguing DSPs like Spotify in the market - as I mentioned last week.

But here’s a kicker for the uninitiated - Spotify’s business model prioritizes adoption and market share before monetization. As Kaefer acknowledged, Nigeria is among the markets where Spotify’s investment is already yielding results. It might not yet be in profitability terms per se, but certainly in cultural and market penetration, and that distinction matters. For a business like Spotify, which has always banked on the long game through a freemium model, the focus is on building habit, routine, and ubiquity. Currently, the company converts only about 39% of its global Monthly Active Users (MAUs) to Premium, as it believes that once it controls the listener’s attention, the money will follow. This strategy of “seed, grow, dominate” is clearly playing out in Nigeria, and there’s proof further down.

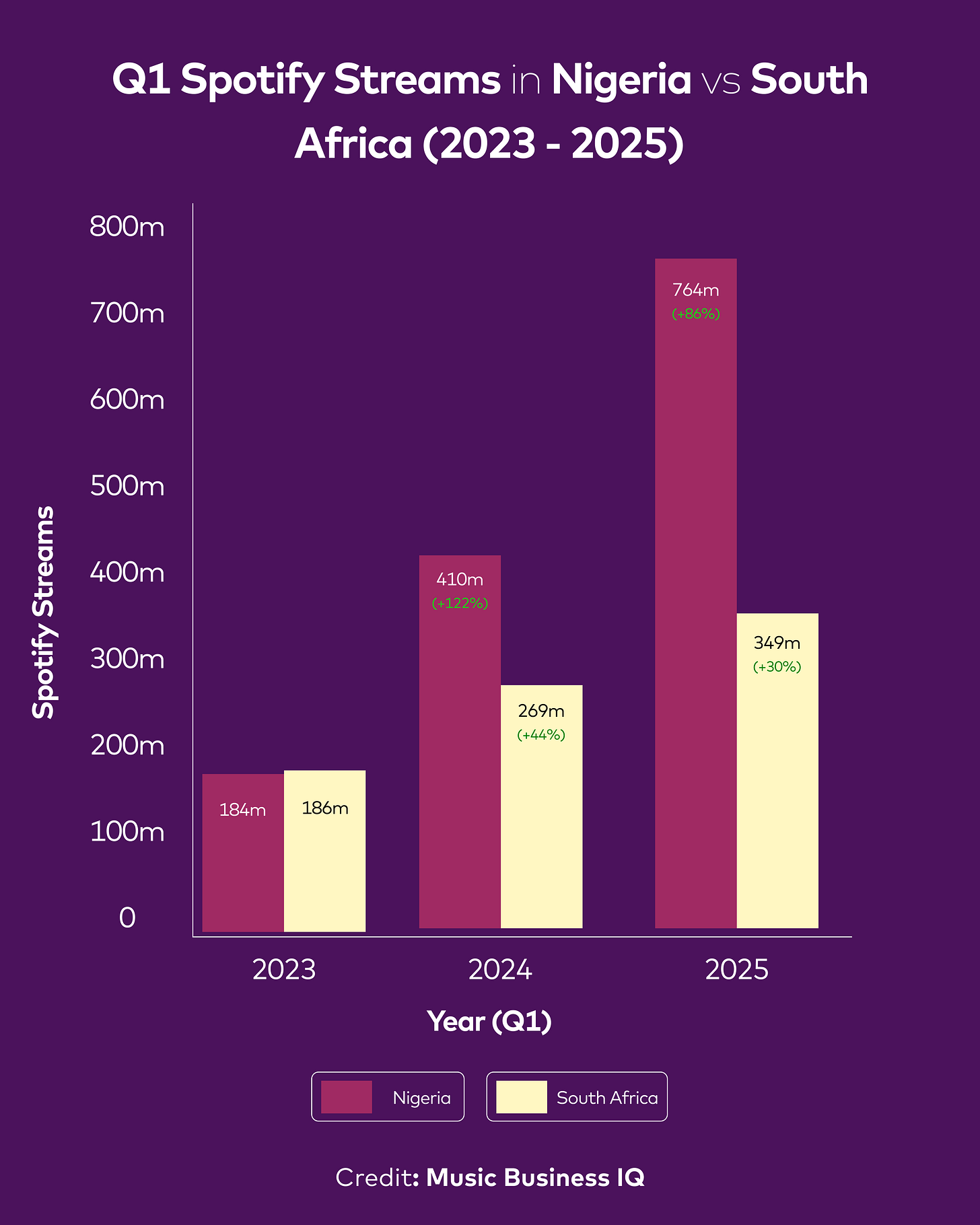

Lets start with recalling Spotify’s adoption by streaming volumes across Nigeria and South Africa in the first quarter of the last three years.

Since 2023, Spotify streams in Nigeria have grown more than 4x. In contrast, South Africa has grown, but at a slower pace, even though the region still commands a significant share of revenue from Sub-Saharan Africa (but that’s not the conversation today, please).

I don’t fancy sounding cheesy, but the Spotify Nigeria story is probably a testament to how deliberate engagement and local investment can accelerate growth, if you will.

In the first 12 weeks of 2025 (Q1), Nigerians contributed over 764 million streams to Spotify across 360+ titles. The most streamed track in the past quarter by Nigerians, “Joy Is Coming” by Fido, earned almost 17 million streams - whereas the most streamed song (“Egwu”) around same period last year had over 9 million streams. The ten best-performing songs alone contributed over 116 million of those streams; up from 61 million in Q1 2024, about a 90% year-on-year increase.

In South Africa, however, Q1 2025 streams totaled 349 million across almost 400 titles, with the most streamed song, “Vuka” by Oscar Mbo et al., earning 5.6 million streams - whereas the most streamed song (“Imithandazo”) around same period last year had over 8 million streams. The Top 10 songs gathered just under 42 million, about flat compared to 2024.

So, the above data shows that Nigerians are adopting Spotify at an incredible rate and speaks true to Spotify’s investment in the market paying off, but it doesn’t necessarily confirm whether Spotify has overtaken contemporaries like Apple Music to become the leading DSP in Nigeria. Apple Music is quite clandestine with its data, so I resorted to what I’d call artist disclosures, while cross-referencing some first-party analytics with internal data and insights from rightsholders (confidential, of course, so there’s only so much I can share here).

Artist Disclosures

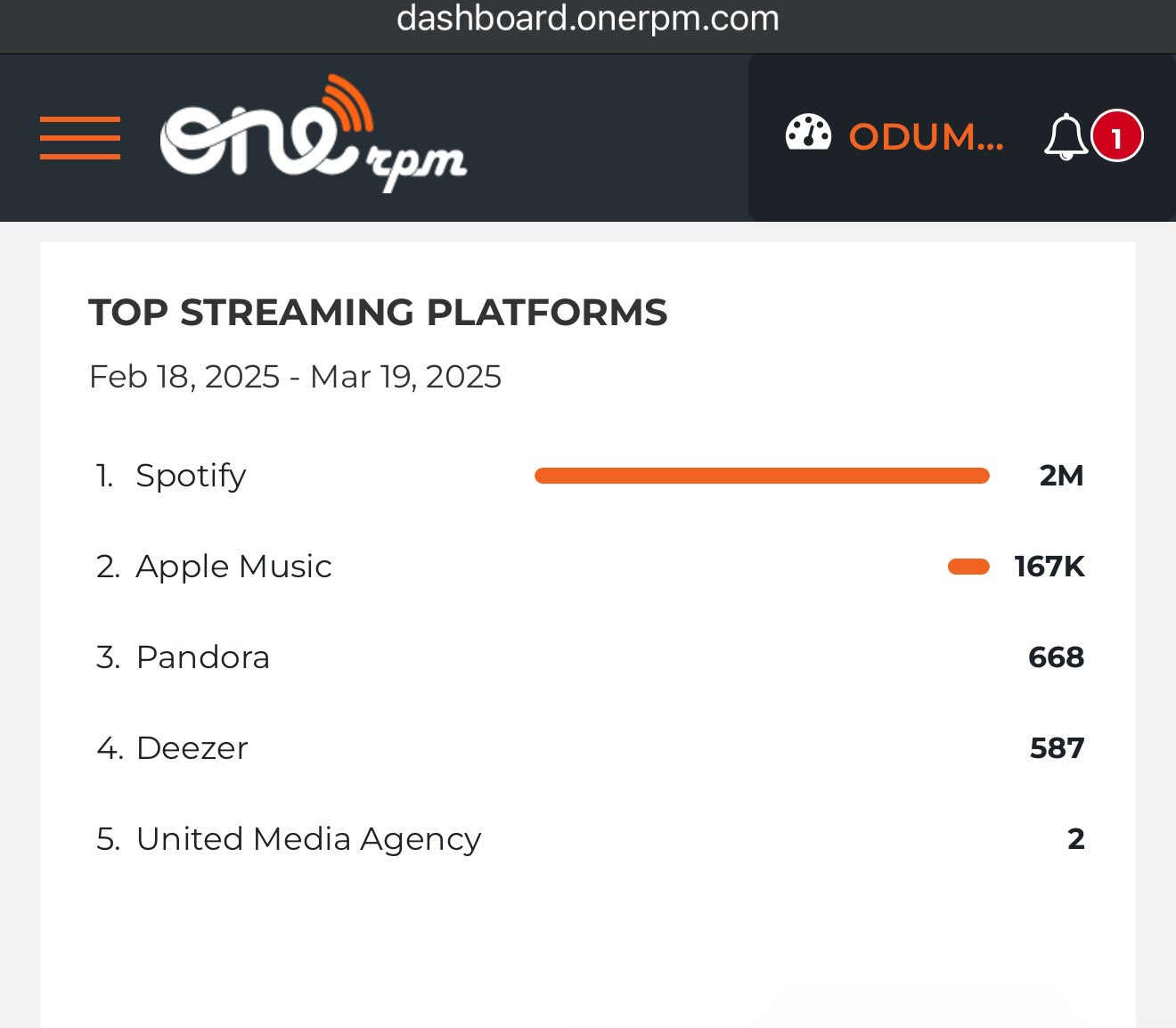

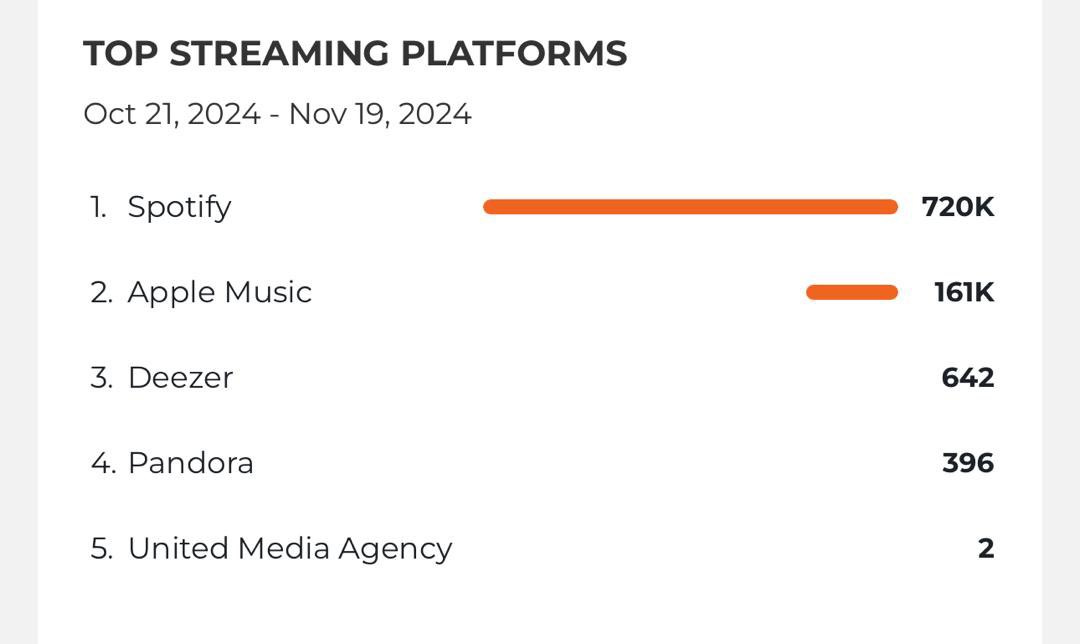

For artist disclosures, I noticed a key data point when Odumodublvck, one of the Nigerian acts with considerable streaming muscle, posted a screenshot of streaming performance for his select catalogue under ONErpm, and it was glaring how Spotify led…significantly.

Within a one-month period, the rapper garnered about 2 million streams on Spotify across his catalogue on ONErpm; over ten times more than what he got from Apple Music within the same period. Here’s another screenshot below showing Spotify netting about four times more.

Peep how the Spotify streams grew between 2024 (below photo) and 2025 (above photo) and compare it to Apple Music streams maintaining about same figures from 2024 to 2025.

First-Party Analytics & Confidential Rightsholder Insights

Next, I turned to some first-party analytics to identify the songs Nigerians have streamed the most in Q1 2025 on Spotify - which are also some of the biggest releases this year, so far. Then, I cross-referenced this with internal data from select rightsholders (who shall remain unnamed for confidentiality reasons) across 10 top-performing tracks in Nigeria in Q1 ‘25; and the pattern held. In almost every case, Spotify streams surpassed Apple Music streams by at least 30%, and in some cases as high as 140%.

If these are anything to go by, it suggests that Spotify’s MAU (Monthly Active Users) base in Nigeria is growing at a massive rate. And yes, Spotify benefits from a free tier and Apple Music doesn’t but scale is scale and on sheer volume, Spotify appears to have edged ahead.

Apple Music doesn’t offer a free tier, so all its streams come from paid users. Spotify, by contrast, splits streams between its free and Premium tiers. So a fair question is: how much of these Spotify figures [say song with 12 million streams] came from paying users? But even if you halve the Spotify figure to be conservative, the platform still shows stronger engagement on stream volume alone over Apple Music.

However, I think I’d be remiss not to mention that I’m unsure about the current rate of Spotify’s conversion to premium users in Nigeria. Pretending I’m not privy to any confidential info, I would say Apple Music, with its all-paid model, may still lead in ARPU (Average Revenue Per User) in Nigeria. But when you think about it really, payment accessibility remains a critical factor in platform adoption and ARPU in Nigeria and here, I think Spotify still appears to have an edge.

One of the barriers for Nigerian users on Apple Music is the difficulty with payment cards. Many Nigerian debit cards, especially those issued by local banks still face compatibility issues with Apple’s billing system. As a result, users frequently resort to workarounds like the Family Sharing plan, which dilutes the per-user revenue Apple generates in the region. In contrast, Spotify’s local billing setup is far more seamless. I personally use my GTBank [Naira] card with zero friction, and that ease of access is echoed by many other Nigerian users.

Spotify accepts local Naira cards and has optimized for the Nigerian payments ecosystem in a way Apple hasn’t fully managed yet. This disparity likely plays a role in user migration. Anecdotally and structurally, it’s clear that ease of payment is influencing platform loyalty. And more importantly, it may be giving Spotify an advantage not just in user numbers, but in paid user growth and ARPU within the Nigerian market. And if the [confidential] data I’m privy to about Nigerian subscriber metrics across major DSPs is anything to go by, which sees Spotify in a hot lead in subscriptions, it’s not surprising how that must’ve come about in the last four years.

But…but Apple Music is probably not backing down just yet. Last month, Ole Obermann left his role as Global Head of Music Business Development at ByteDance [parent company of TikTok] after five and a half years to join Apple Music in a newly created role focused on music strategy and innovation. Obermann was responsible for driving ByteDance/TikTok’s music strategy and has served in various senior digital roles at Warner Music Group and Sony Music Entertainment. Would part of his mandate be to grow adoption of Apple Music in more regions where Spotify seems to be leading, also amidst YouTube Music aggressive penetration?

I guess we’ll find out more as events unfold...